Press Release

|May 15,2025New Private Home Sales Fell By 9% In April From March On US Tariffs Concerns And Dearth Of OCR Launches; The City Fringe Led Sales - Spurred By Marina South Project

Share this article:

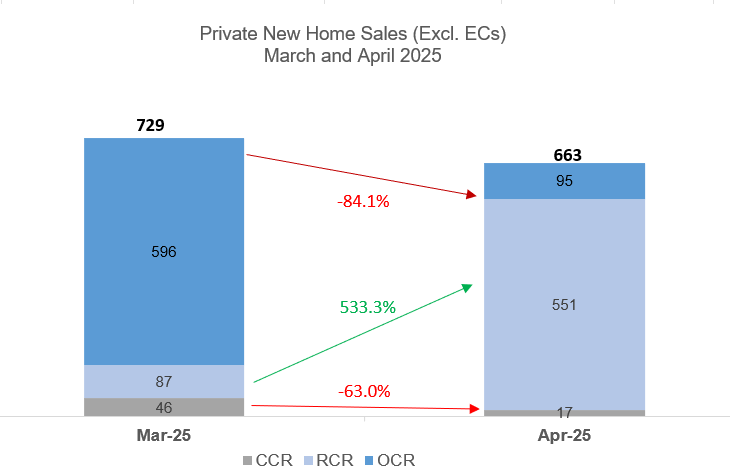

15 May 2025, Singapore - Developers' sales dipped in April from March, partly on concerns arising from the US tariffs, as well as a lack of mass market new launches during the month. There were 663 new private homes (ex. executive condos) sold in April, down by 9.1% from the 729 units transacted in the previous month. On a year-on-year basis, developers' sales more than doubled from the 301 units shifted in April 2024.

There were three new projects launched in April, two being the 358-unit Bloomsbury Residences in Media Circle, and the 937-unit One Marina Gardens in Marina South. They are the first private housing projects to hit the market in their respective new housing precincts. The two projects collective sold 491 units, accounting for about 74% of the monthly new home sales. Meanwhile, a freehold luxury boutique development 21 Anderson was also launched for sale during the month.

In April, developers launched 1,344 new units (ex. EC) for sale, which is a 142% jump from the 555 units launched in March.

With both new launches - Bloomsbury Residences and One Marina Gardens - located in the Rest of Central Region (RCR), it is not unexpected that this sub-market led sales in April. Developers sold 551 new units in the RCR in the month - more than six times higher than the 87 units transacted in March. The sales were mainly from One Marina Gardens which sold 384 units at a median price of $2,948 psf, and Bloomsbury Residences which moved 107 units at a median price of $2,454 psf (see Table 2). Other RCR projects such as Grand Dunman and The Continuum also continued to pare down on unsold stock, selling 14 units and 11 units, respectively in April.

The Outside Central Region (OCR) made up 14% of April's sales, with 95 new private homes (ex. EC) sold during the month. This is a sharp 84% fall from the 596 units transacted in March, where the launch of Lentor Central Residences had helped to lift OCR sales then. The 95 units sold in April is the lowest monthly sales tally in 14 months, since 58 OCR units changed hands in February 2024. The best-selling OCR projects in April were Parktown Residence which sold 17 units at a median price of $2,368 psf, and Lentor Mansion which moved 12 units at a median price of $2,183 psf.

Over in the Core Central Region (CCR), developers' sales remained relatively tepid, with 17 new units sold in April - representing a 63% decline from the 46 units shifted in the previous month. This is also the slowest monthly sales in the CCR since September 2024, where 15 new units were transacted in this sub-market. The CCR projects that topped sales in April were Hill House which sold 4 units at a median price of $3,017 psf, and 21 Anderson which transacted 3 units at a median price of $4,811 psf.

In the EC segment, developers sold 96 new units, markedly lower than the 781 units transacted in March, where the 760-unit Aurelle of Tampines had turbocharged EC sales. In April, Aurelle of Tampines once again led EC sales - shifting 54 units at a median price of $1,764 psf. Of note, the 616-unit North Gaia in Yishun is now fully sold, after shifting two units in April. As at end-April, there were only 52 units of unsold new ECs on the market. The limited EC supply will be supportive of sales at the upcoming Otto Place EC in Plantation Close, which is expected to be launched in the second half of the year.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"Developers sold 663 new homes (ex. EC) in April, setting up what will likely be an improved second quarter performance in 2025 compared with a year ago. The sales tally in April alone is already some 91% of the 725 units transacted in the entire Q2 2024.

April's sales were spearheaded by One Marina Gardens in Marina South which sold 384 units (or 41% of the total units), followed by Bloomsbury Residences where 107 units (30% of total) were transacted. While the take-up rates for April's launches paled in comparison with that of some projects which hit the market in Q1 2025, we believe their sales have been commendable, particularly in a month where there was much uncertainty and financial market volatility due to the announcement of the US tariffs. Of note, One Marina Gardens' performance has been very positive, given that the project is not near to schools nor HDB estates, which tend to offer a demand catchment for new launches from HDB upgraders.

Overall, the transactions at One Marina Gardens have helped to prop up the median unit price of non-landed new private homes sold in the RCR in April, leading to a wider 29.9% price gap against the median unit price in the OCR - versus the 19.3% corresponding price gap in March (see Table 1). Meanwhile, the price gap between CCR and RCR narrowed to 11.3%, while the CCR pulled away from the OCR with a 44.6% price gap in April. That said, the transaction volume in the CCR was thin.

Table 1: Median unit price of non-landed new private homes sold (ex. EC) by region, by month, and price gap (%)

Median unit price ($PSF) non-landed new sales (ex. EC) | Price gap (%) | |||||

CCR | RCR | OCR | CCR vs RCR | CCR vs OCR | RCR vs OCR | |

Jan-25 | $2,538 | $2,725 | $2,419 | -6.9% | 4.9% | 12.6% |

Feb-25 | $3,211 | $2,606 | $2,382 | 23.2% | 34.8% | 9.4% |

Mar-25 | $2,989 | $2,643 | $2,216 | 13.1% | 34.9% | 19.3% |

Apr-25 | $3,242 | $2,912 | $2,242 | 11.3% | 44.6% | 29.9% |

MOM % change | 8.5% | 10.2% | 1.2% |

|

|

|

In April, the priciest new homes sold were all at 21 Anderson in the CCR, based on caveats lodged. The three units transacted are priced at around $21 million to $23 million, making them one of the highest valued new condo deals in 2025 - just after a unit at Park Nova which fetched nearly $38.9 million ($6,593 psf) in January. Of the three units sold at 21 Anderson, two are purchased by Singapore PRs and one unit by a Singaporean buyer.

Overall, foreigners (non-PR) accounted for 2.4% of the non-landed new private home sales (ex. EC) in April 2025, the highest proportion in four months, according to caveat data. In absolute terms, there were 16 deals by foreigners in April, namely 10 transactions at One Marina Gardens, and one unit each at Bloomsbury Residences, Lentor Central Residences, Parktown Residence, and The Myst, as well as two units at Watten House. Meanwhile, Singapore PRs and Singaporeans made up 12.1% and 85.5% of the non-landed new private home sales (ex. EC) in April.

We expect developers' sales could be relatively subdued in May, as there have been no new projects being launched thus far. In the coming months, new home sales may increasingly be driven by the CCR and RCR, amidst a limited number of OCR launches.

While the US tariffs have introduced uncertainty into the market, the situation is evolving and recent US-China talks have led to a significant dial back of trade tariffs for a 90-day period. The de-escalation in US-China trade tensions will offer some temporary reprieve, although underlying volatility remains. Meanwhile, we are cautiously optimistic about the private housing market in Singapore, in view of the stable demand for homes, the tight labour market, as well as a relatively manageable level of unsold inventory, which stood at 18,125 units (ex. EC) in Q1 2025. For comparison, the number of unsold uncompleted private homes during uncertain times previously was at 29,149 units in Q1 2020 when the Covid-19 pandemic struck, and at around 43,000 units in 2008 amidst the global financial crisis.

In the first four months of 2025, developers sold 4,038 new private homes (ex. EC) - which is about 62% of the developers' sales volume (6,469 units) in the whole of 2024. PropNex projects that new home sales could come in at 8,000 to 9,000 units (ex. EC) this year, supported by the ample supply of new launches lined up."

Table 2: Top-Selling Private Residential Projects (ex. EC) in April 2025

| S/n | Project | Region | Units sold in Apr 2025 | Median price in Apr 2025 ($PSF) | |

1 | ONE MARINA GARDENS | RCR | 384 | $2,948 | |

2 | BLOOMSBURY RESIDENCES | RCR | 107 | $2,454 | |

3 | PARKTOWN RESIDENCE | OCR | 17 | $2,368 | |

4 | GRAND DUNMAN | RCR | 14 | $2,599 | |

5 | LENTOR MANSION | OCR | 12 | $2,183 | |

6 | LENTOR CENTRAL RESIDENCES | OCR | 11 | $2,384 | |

| THE CONTINUUM | RCR | 11 | $2,900 | |

7 | PINETREE HILL | RCR | 9 | $2,654 | |

8 | THE LAKEGARDEN RESIDENCES | OCR | 8 | $2,152 | |

9 | THE ARDEN | OCR | 7 | $1,753 | |

| THE ORIE | RCR | 7 | $2,695 | |

| LENTORIA | OCR | 7 | $2,273 | |

10 | HILLOCK GREEN | OCR | 6 | $2,192 | |